How To Calculate Mileage Expenses . mileage calculator for uk business expenses. Enter your route details and price per mile, and total up your distance and expenses. to calculate the ‘approved amount’, multiply your employee’s business travel miles for the year by the rate per mile for their. You can calculate car and car fuel benefits by. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for. Been on a business trip lately? If you’ve travelled under 10,000 miles in the current tax year you can use this. calculating mileage for business expenses. The calculation for cars and vans. company car and car fuel calculator — company cars. the mileage calculator is easy to use. For the first 10,000 miles, a flat rate is applied per.

from irs-mileage-rate.com

The calculation for cars and vans. company car and car fuel calculator — company cars. Been on a business trip lately? the mileage calculator is easy to use. mileage calculator for uk business expenses. If you’ve travelled under 10,000 miles in the current tax year you can use this. to calculate the ‘approved amount’, multiply your employee’s business travel miles for the year by the rate per mile for their. You can calculate car and car fuel benefits by. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for. calculating mileage for business expenses.

Government Mileage Calculator IRS Mileage Rate 2021

How To Calculate Mileage Expenses calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for. company car and car fuel calculator — company cars. For the first 10,000 miles, a flat rate is applied per. mileage calculator for uk business expenses. calculating mileage for business expenses. If you’ve travelled under 10,000 miles in the current tax year you can use this. to calculate the ‘approved amount’, multiply your employee’s business travel miles for the year by the rate per mile for their. Enter your route details and price per mile, and total up your distance and expenses. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for. Been on a business trip lately? The calculation for cars and vans. You can calculate car and car fuel benefits by. the mileage calculator is easy to use.

From ihsanpedia.com

How To Calculate Mileage A Comprehensive Guide IHSANPEDIA How To Calculate Mileage Expenses The calculation for cars and vans. If you’ve travelled under 10,000 miles in the current tax year you can use this. company car and car fuel calculator — company cars. Been on a business trip lately? to calculate the ‘approved amount’, multiply your employee’s business travel miles for the year by the rate per mile for their. . How To Calculate Mileage Expenses.

From www.wikihow.com

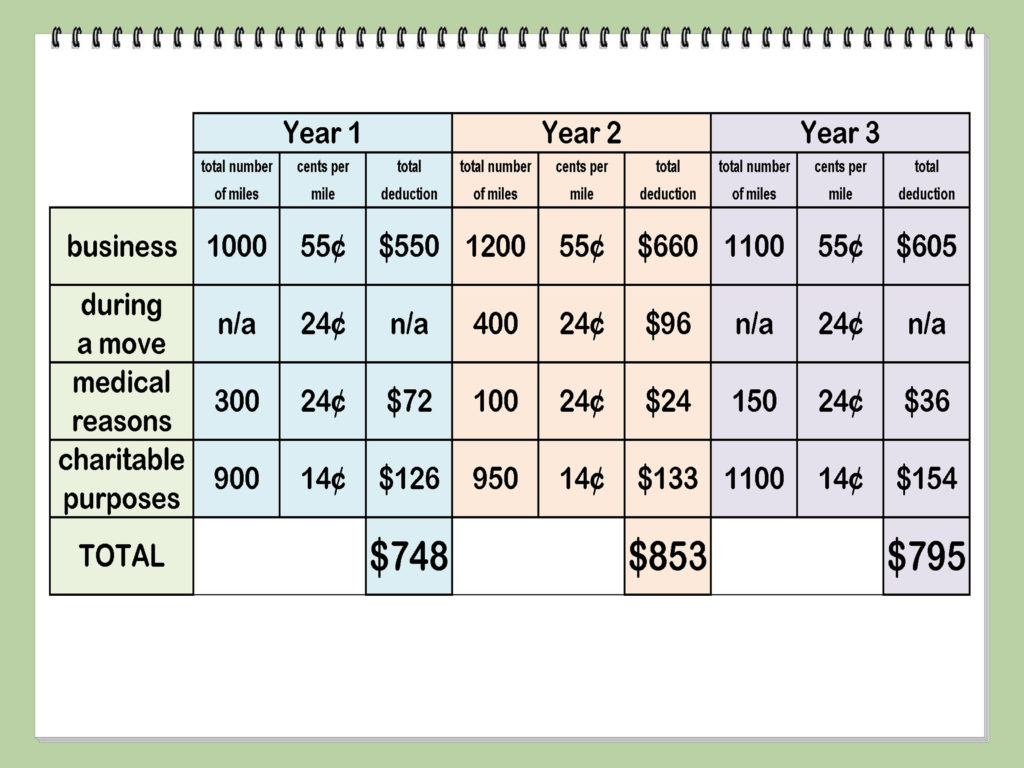

How to Calculate Mileage for Taxes 10 Steps (with Pictures) How To Calculate Mileage Expenses mileage calculator for uk business expenses. Been on a business trip lately? Enter your route details and price per mile, and total up your distance and expenses. If you’ve travelled under 10,000 miles in the current tax year you can use this. calculating mileage for business expenses. the mileage calculator is easy to use. The calculation for. How To Calculate Mileage Expenses.

From towinghome.com

How to Calculate Gas Mileage & Easy MPG Calculator Towing Home How To Calculate Mileage Expenses If you’ve travelled under 10,000 miles in the current tax year you can use this. company car and car fuel calculator — company cars. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for. Enter your route details and price per mile, and total up your. How To Calculate Mileage Expenses.

From www.wikihow.com

How to Calculate Mileage for Taxes 8 Steps (with Pictures) How To Calculate Mileage Expenses mileage calculator for uk business expenses. the mileage calculator is easy to use. If you’ve travelled under 10,000 miles in the current tax year you can use this. calculating mileage for business expenses. company car and car fuel calculator — company cars. to calculate the ‘approved amount’, multiply your employee’s business travel miles for the. How To Calculate Mileage Expenses.

From www.keepertax.com

Mileage vs. Actual Expenses Which Method Is Best for Me? How To Calculate Mileage Expenses Enter your route details and price per mile, and total up your distance and expenses. to calculate the ‘approved amount’, multiply your employee’s business travel miles for the year by the rate per mile for their. mileage calculator for uk business expenses. If you’ve travelled under 10,000 miles in the current tax year you can use this. . How To Calculate Mileage Expenses.

From www.youtube.com

Gas Mileage Calculator Tutorial YouTube How To Calculate Mileage Expenses For the first 10,000 miles, a flat rate is applied per. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for. mileage calculator for uk business expenses. to calculate the ‘approved amount’, multiply your employee’s business travel miles for the year by the rate per. How To Calculate Mileage Expenses.

From www.exceldemy.com

How to Calculate Mileage in Excel (StepbyStep Guide) How To Calculate Mileage Expenses The calculation for cars and vans. the mileage calculator is easy to use. You can calculate car and car fuel benefits by. Enter your route details and price per mile, and total up your distance and expenses. For the first 10,000 miles, a flat rate is applied per. mileage calculator for uk business expenses. calculating mileage for. How To Calculate Mileage Expenses.

From techguruplus.com

MileageLogAndExpenseReport Template In Excel (Download.xlsx) How To Calculate Mileage Expenses You can calculate car and car fuel benefits by. For the first 10,000 miles, a flat rate is applied per. mileage calculator for uk business expenses. If you’ve travelled under 10,000 miles in the current tax year you can use this. company car and car fuel calculator — company cars. Been on a business trip lately? calculate. How To Calculate Mileage Expenses.

From www.generalblue.com

Employee Mileage Expense Report Template in Excel How To Calculate Mileage Expenses calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for. If you’ve travelled under 10,000 miles in the current tax year you can use this. calculating mileage for business expenses. Been on a business trip lately? mileage calculator for uk business expenses. For the first. How To Calculate Mileage Expenses.

From www.keepertax.com

Mileage vs. Actual Expenses Which Method Is Best for Me? How To Calculate Mileage Expenses calculating mileage for business expenses. the mileage calculator is easy to use. company car and car fuel calculator — company cars. Been on a business trip lately? You can calculate car and car fuel benefits by. The calculation for cars and vans. For the first 10,000 miles, a flat rate is applied per. to calculate the. How To Calculate Mileage Expenses.

From mileiq.com

Free Mileage Log Template for Taxes, Track Business Miles How To Calculate Mileage Expenses calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for. Enter your route details and price per mile, and total up your distance and expenses. Been on a business trip lately? The calculation for cars and vans. For the first 10,000 miles, a flat rate is applied. How To Calculate Mileage Expenses.

From ufreeonline.net

50 Example Mileage Log For Taxes How To Calculate Mileage Expenses You can calculate car and car fuel benefits by. The calculation for cars and vans. If you’ve travelled under 10,000 miles in the current tax year you can use this. mileage calculator for uk business expenses. Enter your route details and price per mile, and total up your distance and expenses. company car and car fuel calculator —. How To Calculate Mileage Expenses.

From www.taxoutreach.org

How to Claim the Standard Mileage Deduction Get It Back How To Calculate Mileage Expenses the mileage calculator is easy to use. For the first 10,000 miles, a flat rate is applied per. calculating mileage for business expenses. You can calculate car and car fuel benefits by. If you’ve travelled under 10,000 miles in the current tax year you can use this. to calculate the ‘approved amount’, multiply your employee’s business travel. How To Calculate Mileage Expenses.

From www.smartsheet.com

Free Mileage Log Templates Smartsheet How To Calculate Mileage Expenses the mileage calculator is easy to use. calculating mileage for business expenses. You can calculate car and car fuel benefits by. The calculation for cars and vans. mileage calculator for uk business expenses. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for. Been. How To Calculate Mileage Expenses.

From www.sdpuo.com

How To Calculate Mileage A Comprehensive Guide The Cognitive Orbit How To Calculate Mileage Expenses company car and car fuel calculator — company cars. If you’ve travelled under 10,000 miles in the current tax year you can use this. For the first 10,000 miles, a flat rate is applied per. Been on a business trip lately? the mileage calculator is easy to use. mileage calculator for uk business expenses. calculating mileage. How To Calculate Mileage Expenses.

From www.youtube.com

Mileage Claims How to calculate and claim mileage expenses using How To Calculate Mileage Expenses calculating mileage for business expenses. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for. company car and car fuel calculator — company cars. For the first 10,000 miles, a flat rate is applied per. mileage calculator for uk business expenses. The calculation for. How To Calculate Mileage Expenses.

From dollarkeg.com

How do i calculate mileage for taxes Dollar Keg How To Calculate Mileage Expenses calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for. to calculate the ‘approved amount’, multiply your employee’s business travel miles for the year by the rate per mile for their. Enter your route details and price per mile, and total up your distance and expenses.. How To Calculate Mileage Expenses.

From www.pinterest.com

This mileage reimbursement form can be used to calculate your mileage How To Calculate Mileage Expenses calculating mileage for business expenses. mileage calculator for uk business expenses. Enter your route details and price per mile, and total up your distance and expenses. calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle, for. company car and car fuel calculator — company. How To Calculate Mileage Expenses.